Managing funds effectively is crucial for Community Interest Companies (CICs) to ensure they meet their social objectives while maintaining financial sustainability. Here’s a guide on how to manage CIC funds efficiently:

1. Create a Comprehensive Budget

- Set Clear Goals: Define the financial and social objectives of your CIC. Your budget should reflect these goals and guide your spending decisions.

- Allocate Resources Wisely: Break down the budget into various categories, such as operational costs, project funding, marketing, and community engagement. This will help ensure that funds are distributed appropriately.

2. Maintain Accurate Financial Records

- Use Accounting Software: Implement accounting software that suits your CIC’s size and needs. This will help automate record-keeping, making it easier to track income and expenses.

- Document Everything: Keep detailed records of all financial transactions, including invoices, receipts, and bank statements. This documentation will support your financial reporting and audits.

3. Monitor Cash Flow Regularly

- Cash Flow Management: Regularly review cash flow to ensure you have enough funds to meet operational needs and project commitments. Keep track of income and expenses to anticipate potential shortfalls.

- Use Cash Flow Projections: Create cash flow forecasts to predict future cash needs and plan accordingly. This will help identify any potential funding gaps in advance.

4. Implement Financial Controls

- Internal Controls: Establish internal controls to safeguard against fraud and mismanagement. This may include requiring dual signatures for large expenditures or regularly reviewing financial transactions.

- Regular Audits: Conduct internal audits periodically to assess financial processes and ensure compliance with regulations. Consider having an independent examination if your CIC is exempt from a full audit.

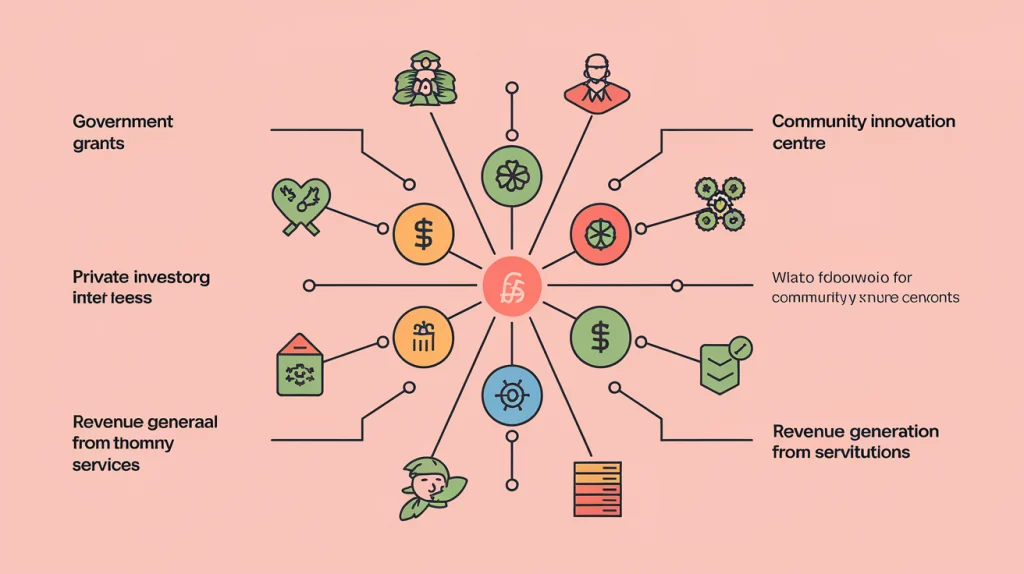

5. Diversify Funding Sources

- Multiple Revenue Streams: Explore various funding sources, such as grants, donations, crowdfunding, and income-generating activities. Diversifying funding can reduce reliance on a single source and enhance financial stability.

- Social Investment: Look for social investors or impact funds that align with your mission. These investments can provide the necessary capital to scale your operations.

6. Engage with Stakeholders

- Communicate with the Community: Keep stakeholders informed about how funds are being used and the impact of projects. Transparency fosters trust and encourages continued support from the community.

- Involve Staff and Volunteers: Encourage staff and volunteers to participate in financial planning and management discussions. Their insights can help identify areas for improvement and innovative funding ideas.

7. Review and Adjust Financial Plans

- Regular Financial Reviews: Schedule regular reviews of your financial performance against the budget. This allows you to identify variances and adjust your plans as needed.

- Adapt to Changing Circumstances: Be prepared to pivot your strategies based on changes in funding availability, community needs, or project outcomes. Flexibility is key to managing funds effectively.

8. Plan for Sustainability

- Long-Term Financial Planning: Develop a long-term financial plan that outlines how you will sustain your CIC’s operations and impact over time. Consider factors such as funding cycles, project longevity, and community engagement.

- Reinvestment Strategy: Establish a strategy for reinvesting profits back into the CIC or community projects, aligning with the asset lock principle that ensures funds benefit the community.

9. Ensure Compliance with Regulations

- Understand Legal Obligations: Familiarize yourself with the legal requirements for managing funds as a CIC, including financial reporting and compliance with the asset lock.

- Stay Informed on Changes: Keep up to date with any changes in regulations or funding opportunities that may affect your CIC’s financial management.

Conclusion

Effectively managing CIC funds is essential for achieving your social mission and ensuring financial sustainability. By implementing sound financial practices, engaging with stakeholders, and continuously monitoring performance, your CIC can thrive and make a positive impact in the community. Consider seeking guidance from financial professionals or networks of other CICs to enhance your financial management practices further.